9.27.23 -- C&C News

“Lawsuit Against Trump – Practicing Lawyer Says Value of Properties Is Always Subjective”

By Jeff Childers – practicing attorney and well-known author

Excerpts from this article:

…Ruling in a civil lawsuit brought by woke, Soros-funded New York Attorney General Letitia James, New York state judge Arthur Engoron found that Trump and his company had “deceived” banks, insurers and others by “massively overvaluing” his assets and “exaggerating his net worth” on applications and financial statements used while making real-estate deals and securing bank loans.

The first thing to understand about the decision is that NO ONE WAS HARMED. Trump paid all his loans back in full, on time.

Letitia’s case is only about what Trump put down on the financial statements that were provided to extremely sophisticated financial professionals who didn’t rely on them.

Letitia and Judge Engoran relied on a goofy New York law criminalizing “falsifying” financial documents — a unique law that doesn’t require even one single victim.

This case is right in my wheelhouse; I’ll explain the whole thing. It’s not complicated.

The judge’s 35-page decision is, at bottom, only about how President Trump valued his real estate holdings when he was providing his personal financial statement to various people.

I am qualified to comment because half of my commercial litigation cases are disputes over real estate. Before tumbling into constitutional and civil rights law, I also had a strong side practice in commercial loan workouts — negotiating for developers with banks — and commercial Chapter 11 bankruptcy, which (at least in Florida) is all about valuing real estate.

Principle number one: Real estate valuation is not a science because values are SUBJECTIVE. Every effort to value real estate is just a GUESS at what someone will eventually be willing to pay for the land. Your dilapidated barn might be someone else’s castle.

Real estate — buildings and land — is worth different amounts to different people…

Lawyers think about real estate values in three general categories, depending on who is doing the valuing. From lowest value to highest, the normal categories are: (1) the tax appraised value (the lowest, and least likely to be accurate), (2) the “forced liquidation” value (think foreclosure sale), and (3) then the highest, the “market” value (determined by professional appraisers who assume that the seller can market the property without pressure or time constraints).

Even professional appraisers disagree on land value. Every single one of my cases involves competing appraisals, and the appraisers’ numbers are often wildly different.

Lawyers and judges all know that appraisals are just guesses. When I negotiate with bank lawyers, I often offer to bet them a month’s salary that when the appraised property finally sells, it will bring a price at least 15% different than the bank’s appraisal. In all these years, no opposing lawyer has ever taken that bet.

(4) A fourth category of valuation is the owner’s opinion of his property’s value. Even though an owner might not be a real estate expert, the law considers the owner well positioned to know the value of their own property. They probably think about it a lot. They know all the pro’s and con’s.

Therefore under the law, an owner’s opinion is admissible evidence of value.

The lowest valuation is usually the tax appraised value, which is the amount used by the state to calculate annual property taxes.

There’s a good reason why it’s the lowest: tax appraisers calculations are limited in many ways under state law.

For example, in Florida tax appraisers can’t increase the value of homestead property — where someone lives — more than a few percentage points at a time. Tax appraisers also can only change the assessment when certain things happen, like when a property is sold.

NEW YORK JUDGE ENGORAN

Judge Engoran ruled yesterday that Trump had “inflated” his property values on his financial statements. Meaning, the judge decided what the properties were worth and then found that Trump overestimated Trump’s values — on paper.

Take for example Trump’s residence, Mar-a-Lago, which the judge determined was worth $18 million for the entire ten-year period between 2011 and 2021.

That determination was based only on the county tax assessor, who appraised its value between $18 and $27 million.

So of course THE JUDGE USED THE LOWEST NUMBER in that range, $18 million, comparing that to Trump’s value of between $426 million and $612 million:

Nobody would use the tax appraiser’s value to guess at Mar-a-Lago’s selling price.

So Forbes estimated Mar-a-Lago’s value between $200 million and $725 million, based on broker opinions, and ultimately went with “a conservative” $350 million.

Mar-a-Lago is spectacular, historic, all-stone, luxury oceanfront property that looks like a castle and is the size of a small hotel. For comparison, a 5-bedroom home recently sold in the same neighborhood for $75 million.

MAR-A-LAGO

The $18 million value is a JOKE.

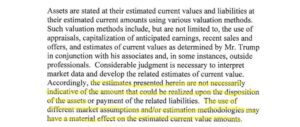

…All of Trump’s financial statements — again, provided to sophisticated financial professionals — included a prominent disclaimer saying that actual real estate values could be wildly different than what was put down. The judge even reprinted the disclaimer in full in his opinion:

But Judge Engoran breezily waved the disclaimer aside, in essence holding that Trump “should have known better anyway.”

The judge then went through all Trump’s other LLCs and properties and applied the same logic, finding Trump’s guesses at the value of his real estate were “false.”

The practical effect, as I read the order, is that the judge has ordered Trump to stop doing business in New York, and ordered Trump’s properties to be fire-sold under a court-appointed receiver. Again — even though nobody was harmed.

I assume President Trump’s lawyers will appeal this awful decision. Stay tuned.